Welcome back!

Here’s your must-read news this morning:

I’ve got all the details for you, so let’s dive in.

— Josh

MARKETS

💰 Netflix to Buy Warner Bros. Film and Streaming Assets in $82.7 Billion Deal

(Credit: Cottonbro Studio/Pexels)

The Scoop: Netflix struck a blockbuster $82.7 billion deal to acquire Warner Bros.’ film studio and HBO Max, ending a fierce bidding war with Paramount Skydance and Comcast and reshaping the global streaming and film industry, CNBC reports.

The Details:

The deal values Warner Bros. Discovery at $72 billion in equity, or $27.75 per share.

WBD shareholders will receive $23.25 in cash and $4.50 in Netflix stock per share.

Netflix will acquire the Warner Bros. film studio and HBO Max streaming service.

Warner Bros. Discovery will spin off Discovery Global, which includes TNT, CNN, and other pay-TV networks.

Both companies’ boards unanimously approved the transaction.

Netflix agreed to a $5.8 billion reverse breakup fee if the deal fails regulatory approval.

Warner Bros. Discovery would pay a $2.8 billion breakup fee if it walks away.

What’s Next: Regulators and shareholders will now determine the fate of the deal, with antitrust scrutiny likely to intensify as Netflix positions itself to dominate both streaming and legacy Hollywood production on a global scale.

Market Roundup

🏦 Economy

⭐ Editor’s Pick: U.S. employers announced over 1.17 million job cuts through November, the highest year-to-date total since the 2020 pandemic peak. (CNBC)

Cyber Monday online sales rose 6.8% year-over-year according to third-party reports, outpacing last year's 5.2% growth.

Nature retracted a study forecasting severe climate-driven economic losses after authors acknowledge substantial data and methodological flaws that overstated damages. (WSJ)

U.S. Trade Representative Jamieson Greer signaled Trump may withdraw from the USMCA next year ahead of its mandatory review. (RTS)

White House economic adviser Kevin Hassett forecasted a 25-basis-point rate cut at next week's Federal Reserve meeting. (INV)

📈 Hot Stock Picks

⭐ Editor’s Pick: Medtronic is poised for strong gains in 2026 as it launches the Hugo robotic surgery system and capitalizes on its innovative cardiac treatments, according to Motley Fool. (MF)

Morningstar identified undervalued utilities stocks—including Portland General Electric and Essential Utilities—as top buys, citing stable demand, high dividend yields. (MS)

Casey's General Stores scored bullish analyst upgrades with price targets reaching $600 amid strong same-store sales and reaffirmed 10-12% EBITDA growth guidance for 2026. (BAR)

🏢 Industry

⭐ Editor’s Pick: Warner Bros. Discovery entered exclusive talks to sell its film and TV studios plus HBO Max streaming service to Netflix, with a potential $5 billion breakup fee. (BBG)

Trump pardoned Oak View Group co-founder Tim Leiweke, nullifying his administration's indictment for allegedly rigging bids on a University of Texas arena project. (WSJ)

Dollar General plans to open roughly 450 new U.S. stores in 2026 alongside remodels and relocations. (FBN)

Apple announced the departures of general counsel Kate Adams and policy chief Lisa Jackson. (CNBC)

The New York Stock Exchange named tech podcast TBPN as its exclusive exchange partner, granting hosts access to the trading floor and events to amplify coverage of IPOs. (FOR)

🛢️ Energy & Commodities

⭐ Editor’s Pick: Trump brokered a peace agreement between Rwanda and the DRC, while securing U.S. access to critical minerals through parallel deals. (WT)

Congress overturned Biden-era restrictions on oil and gas leasing in Alaska's Arctic National Wildlife Refuge. (OP)

Bank of America analysts raised their 2026 silver forecast to a peak of $65 per ounce. (INN)

🌕 Crypto

⭐ Editor’s Pick: CFTC approved Bitnomial as the first regulated U.S. exchange to offer leveraged spot crypto trading. (DEC)

Peter Schiff, unable to verify the authenticity of a physical gold bar handed to him by Changpeng Zhao, underscored Bitcoin's edge in verifiability over tokenized gold. (CT)

Kalshi announced an exclusive partnership with CNBC to integrate real-time prediction market data into its coverage. (TB)

SPONSOR

The New Framework for Enterprise Voice AI

Enterprise teams are automating more calls than ever — but without a consistent framework, deployments become unpredictable, costly, and slow to scale.

The BELL Framework introduces a structured way to design, test, launch, and improve Voice AI agents with reliability.

Get the guide enterprises are now using to de-risk voice automation and accelerate deployment.

TECH

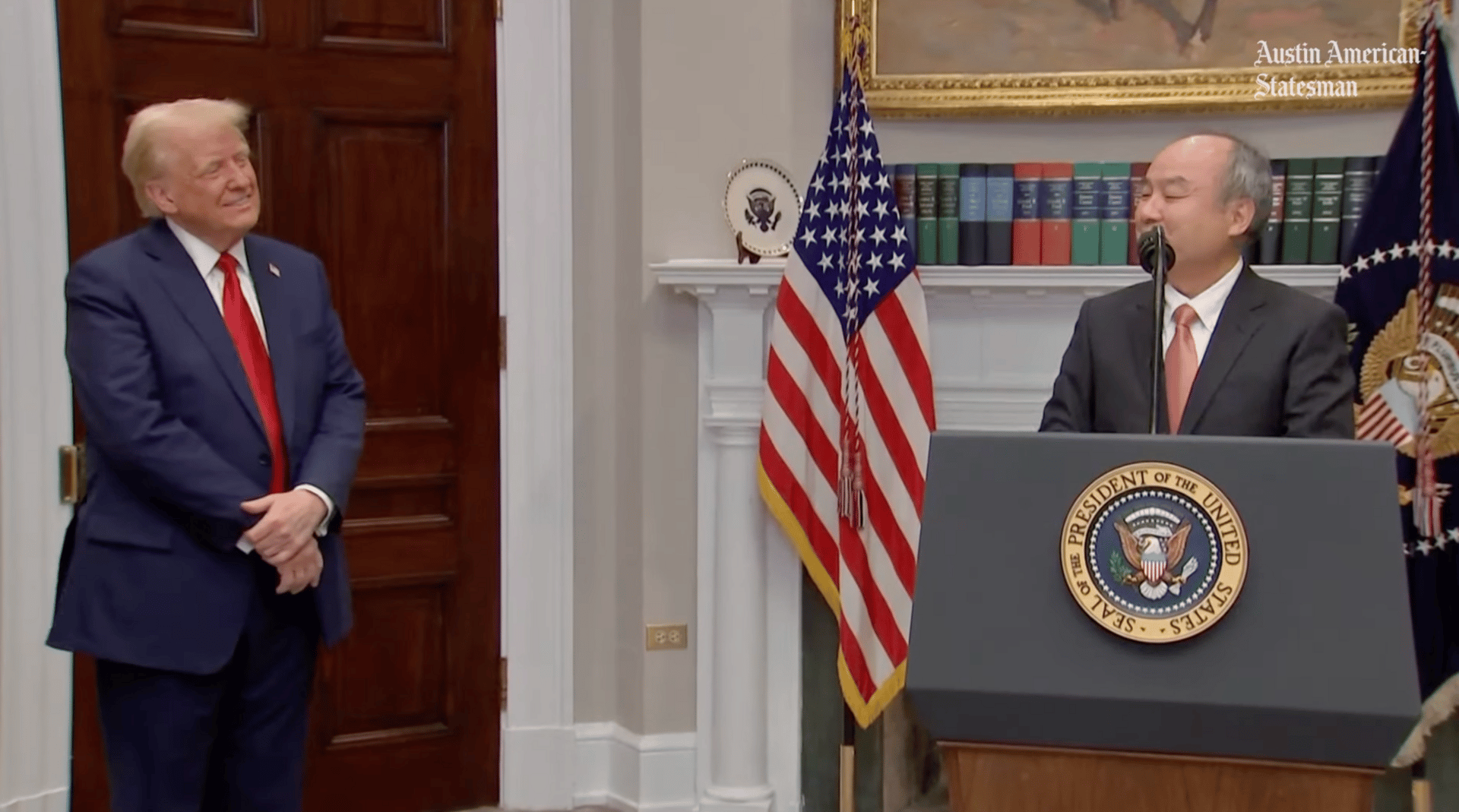

💻 Inside Masayoshi Son's “Trump Industrial Parks” Plan

(Credit: Austin American-Statesman/Screenshot)

The Scoop: SoftBank founder Masayoshi Son is in talks with the Trump administration on a sweeping plan to deploy Japanese capital to build a nationwide network of Trump-backed industrial parks for AI infrastructure, marking one of the most ambitious public-private manufacturing pushes in U.S. history, the Wall Street Journal reports.

The Details:

Son is negotiating with the White House and Commerce Department to mobilize hundreds of billions of dollars into U.S. manufacturing focused on AI infrastructure.

The project will utilize federal land to construct factory clusters producing fiber-optic cable, data-center equipment, power modules, and eventually AI chips.

Funding will primarily come from Japan’s $550 billion U.S. investment pledge under the July U.S.-Japan trade deal.

Under the agreement, the U.S. will retain 90% of project profits after Japan recoups its investment, while maintaining control over fund deployment.

Son initially proposed a $1 trillion “mega-city” in Arizona, modeled after Shenzhen, featuring robotics and worker housing.

This vision was later scaled down to a distributed network of “Trump Industrial Parks” rather than a single futuristic city.

The facilities will be built by SoftBank and its partners but will ultimately be owned by the federal government.

What’s Next: If finalized, Son’s industrial park plan would lock Japan directly into Trump’s AI and manufacturing strategy, reshape how federal land is used for industrial policy, and ignite a new global race to localize AI hardware supply chains.

Tech Roundup

🧠 AI

⭐ Editor’s Pick: Physicist Stephen Hsu claimed a groundbreaking first, publishing a theoretical physics paper in Physics Letters B with a core idea generated by AI model GPT-5. (X)

Two new studies reveal AI chatbots outperform traditional TV campaign ads in persuading voters and shifting political opinions. (WAPO)

Google Cloud partnered with Replit to advance "vibe-coding" AI tools, integrating advanced models for enterprise use and enabling non-programmers to build apps via natural language. (CNBC)

Neuromorphic chips mimicking the human brain could slash AI energy consumption by up to 1,000 times in targeted tasks, offering a promising solution to data centers' power demands. (EDI)

Health and Human Services Department rolled out a new AI adoption strategy, projecting a 70% surge in implementations next year. (AP)

🤖 Defense & Robots

⭐ Editor’s Pick: China’s state media touted the YKJ-1000 hypersonic missile, priced at $99,000, as a potential game-changer poised to disrupt global defense markets. (SCMP)

Pentagon selected over 1,000 companies, including BAE Systems and L3Harris, as potential contractors for its Golden Dome missile defense shield. (DN)

Northrop Grumman unveils its new TALON Collaborative Combat Aircraft after years of secrecy, featuring an upgraded SWORDS version with weapons, built for modern battles and bomb disposal tasks. (TWZ)

Ukrainian military’s advanced MAUL ground robot is now adept at rescuing other robots, as it navigates minefields and mortar strikes. (NGD)

💰Venture Capital

⭐ Editor’s Pick: Phia, founded by Bill Gates' daughter Phoebe to create an AI-powered search engine accessible via Chrome and Safari extensions, raised $30 million at a $180 million valuation, with the round led by Kleiner Perkins. (BBG)

Pine, offering an AI agent to automate digital chores such as making calls and managing emails, secured a $25 million Series A led by Fortwest Capital. (FIN)

Lumia, leveraging AI to analyze interactions between autonomous agents and humans, secures an $18 million seed round led by Team8. (AX)

FREEDOM

👶 Book: Secret Campaign To Demonetize Conservative News Sites Linked To Top Starmer Aide

(Credit: Kirsty O'Connor/ No 10 Downing Street)

The Scoop: As now-British Prime Minister Keir Starmer ascended to power, a covert political operation tied to his inner circle quietly worked to demonetize conservative media outlets Breitbart, The Federalist and ZeroHedge under the banner of fighting “fake news,” according to a trove of documents detailed in Paul Holden’s new book on the Labour Party’s power machine, Drop Site reports.

The Details:

The campaign was executed through an anonymous group called Stop Funding Fake News (SFFN), incubated and supported by the Labour-linked think tank Labour Together.

Labour Together failed to declare £739,000 in donations to the UK Electoral Commission between 2018 and 2020, resulting in a fine in 2021.

Morgan McSweeney, now Starmer’s chief of staff, served as Labour Together’s managing director during the period and was a founding director of the organization that evolved into the Center for Countering Digital Hate (CCDH).

Breitbart became a direct target in October 2019, with SFFN prompting the removal of UK Parliament and Cabinet Office advertising from the site.

The operation expanded to pressure Ford UK and YouTube to limit ads and monetization linked to Breitbart.

SFFN maintained a public advertiser blocklist, enabling brands to mass-ban conservative and independent outlets such as Breitbart, ZeroHedge, and The Federalist.

What’s Next: With Starmer in power and McSweeney entrenched as his top aide, the revelations threaten to ignite a transatlantic political firestorm over covert media suppression, state-adjacent censorship, and the weaponization of “misinformation” campaigns.

Freedom Roundup

🏛️ Policy & Culture

⭐ Editor’s Pick: European Union slapped a €120 million ($140 million) fine on Elon Musk’s X for breaching Digital Services Act transparency rules. (CNBC)

Charlie Kirk’s posthumous book, "Stop, In the Name of God," is a "manifesto against the machine of modern life," encouraging his followers to "stop in the name of God" and honor the Sabbath. (FOX)

Salman Rushdie reflected on surviving a near-fatal stabbing, discussing resilience, freedom of expression, and the personal toll of decades under threat in a candid interview. (BBG)

That's a wrap! You're officially caught up on all things tech, markets and freedom. Subscribe to CAPITAL below.

Feel free to reply to this email with any questions and/or comments.

DISCLAIMER: The CAPITAL newsletter is for informational purposes only and does not constitute financial, investment, or professional advice. Readers should conduct their own research and consult a qualified financial advisor before making investment decisions. The CAPITAL newsletter and its owner and operator, Josh Caplan, are not liable for any loss or damage resulting from reliance on this information. The CAPITAL newsletter is solely owned and independently operated by Josh Caplan, separate from any employer affiliations.