Welcome back!

Here’s your must-read news this morning:

I’ve got all the details for you, so let’s dive in.

— Josh

MARKETS

💰 Vulcan Elements, ReElement Technologies Ink $1.4 Billion Rare Earth Deal with U.S.

(Credit: Herbert2512/Pixabay)

The Scoop: North Carolina startup Vulcan Elements sealed a $1.4 billion deal Monday with ReElement Technologies and the U.S. government to build a fully domestic rare earth magnet supply chain to counter China's dominance with a 10,000-metric-ton annual production facility focused on recycling and U.S.-sourced tech, Mining.com reports.

The Details:

Vulcan, a 2023-founded maker of sintered NdFeB magnets for AI data centers, EVs, drones, and defense, will construct and operate the new plant after finalizing a multi-state site search in weeks.

ReElement, a rare earth recycler, expands processing of end-of-life magnets and e-waste into high-purity oxides, building on their August offtake agreement for light and heavy rare earths.

Funding breakdown: $620M DoD loan to Vulcan, $80M DoD loan to ReElement (both matched by private capital), $50M Commerce equity in Vulcan under CHIPS Act, plus $550M private investment.

In exchange, DoD gets warrants in both firms; Commerce Sec. Howard Lutnick hailed it as accelerating "strong, secure" U.S. manufacturing, while Vulcan CEO John Maslin, a Navy vet, vowed "execution and performance" for national needs.

What’s Next: With site announcements imminent and recycling ramps unlocking scrap supplies, this vertically integrated chain could hit full output by 2027 and slash U.S. reliance on China.

Market Roundup

🏦 Economy

⭐ Editor’s Pick: Senate leaders signaled tentative progress toward a bipartisan compromise to reopen the U.S. government, including an extension of Affordable Care Act tax credits with income caps. (RTS)

The Trump administration will tap $5.25 billion in USDA contingency funds to partially cover November SNAP benefits for 42 million Americans amid the government shutdown. (INV)

Federal Reserve Governor Lisa Cook broke her silence on Trump's bid to oust her over corruption allegations, vowing to press on with her duties. (FBN)

Raymond James analysts hailed the Trump-Xi summit agreements as "overall positive," spotlighting China's suspension of retaliatory tariffs and eased rare-earth export restrictions. (INV)

📈 Stock Market

⭐ Editor’s Pick: Onsemi stock could double in the coming quarters amid a semiconductor supercycle fueled by surging AI and EV demand, according to Market Beat. (MB)

Intellia Therapeutics shares tumbled over 45% after a clinical trial setback caused severe liver damage in a patient, yet Wall Street's $32.30 price target signals a 131% upside potential, according to Motley Fool. (MF)

Barron's recommends buying Boeing stock, eyeing a climb to $230 per share as production ramps up on the 737 Max and 787 Dreamliner. (BAR)

Zacks Investment Research anointed Banco Santander its Bull of the Day with a Zacks Rank #1 (Strong Buy), spotlighting expected earnings growth for 2025. (ZCK)

🏢 Industry

⭐ Editor’s Pick: Palantir posted a Q3 revenue record of $1.18 billion, up 63% year-over-year, while netting $475.6 million in profit that topped Wall Street forecasts. (WSJ)

Kimberly-Clark agreed to acquire Tylenol maker Kenvue in a $40 billion cash-and-stock deal, valuing the enterprise at $48.7 billion. (CNBC)

Norway's sovereign-wealth fund, a major Tesla shareholder, rejected Elon Musk's proposed $1 trillion pay package, citing its immense size and shareholder dilution. (RTS)

France threatened to ban Shein from its market and referred the Chinese e-retailer to Paris prosecutors after an investigation uncovered the sale of "childlike" sex dolls. (NYT)

U.S. Steel announced a $75 million investment at its Fairfield, Alabama, tubular operations plant, creating 44 permanent union jobs and 250 construction roles. (AL)

🛢️ Energy & Commodities

⭐ Editor’s Pick: Ambassador Mike Waltz revealed how Trump pulled off a diplomatic victory by killing plans for a U.N. global green tax that would have burdened U.S. shipping with billions in costs. (BN)

Trump's "drill baby drill" mantra has propelled U.S. oil output to a record 13.6 million barrels daily, with Burgum predicting more fresh highs. (BZ)

Orban is crafting a "grand bargain" with Trump, seeking U.S. recognition of Hungary's Russian energy reliance in exchange for deepened nuclear cooperation on small modular reactors. (UNN)

Wall Street anticipates tokenized gold is poised to be the next frontier to meet surging demand for digital bullion as an inflation hedge. (YF)

🌕 Crypto

⭐ Editor’s Pick: Convicted FTX fraudster Sam Bankman-Fried is appealing his 25-year sentence and ramping up efforts for a Trump pardon. (CNN)

In a "60 Minutes" interview, Trump pledged to make the U.S. “number one” for crypto and referred to CZ's prosecution as a Biden "witch hunt." (TB)

Ripple unveiled a digital-asset spot prime brokerage for U.S. institutions, enabling over-the-counter spot trades across cryptocurrencies via its Hidden Road platform. (CT)

Animoca Brands filed for a Nasdaq listing via reverse merger with Singapore's Currenc Group, forging the first publicly traded diversified digital assets powerhouse. (CD)

SPONSOR

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

TECH

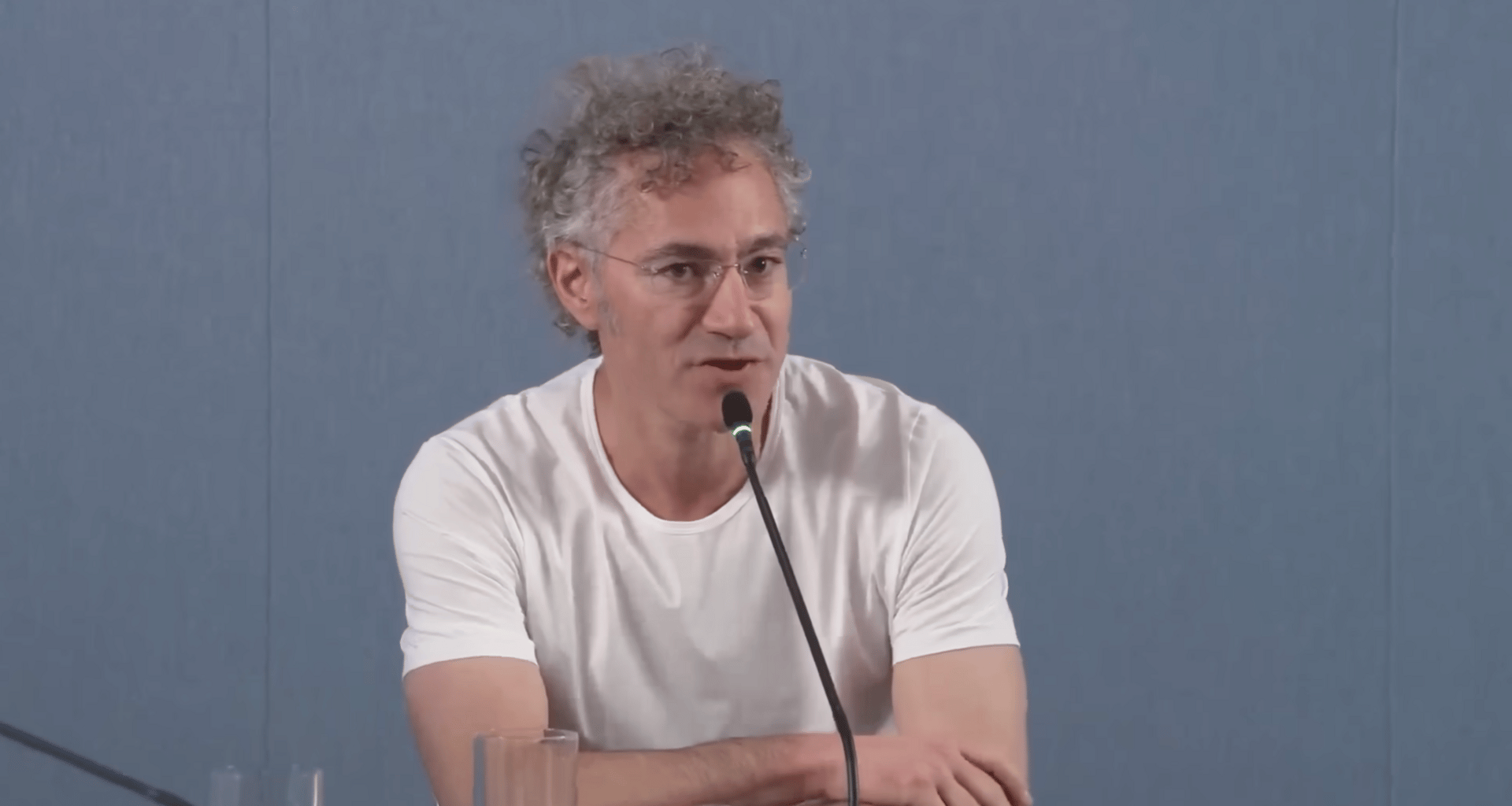

💻 Palantir CEO: If Fentanyl Killed 60K Yale Grads Instead of Working-Class Americans, We’d Drop a “Nuclear Bomb”

(Credit: Apple)

The Scoop: In a viral clip from Palantir's Q3 2025 earnings call, CEO Alex Karp torched open-border policies for enabling the fentanyl crisis that's killing 60,000 working-class Americans a year, while elites turn a blind eye.

The Details:

Karp said, "we'd be dropping a nuclear bomb" if it hit Yale grads instead, and proudly backing U.S. efforts to crush traffickers while elites hoard empathy.

Open borders mean “the average poor American earns less,” Karp continued, slamming the Constitution-twisting insanity of allowing 60,000 annual deaths.

Karp added that Palantir stands “on the side of the average American who sometimes gets screwed because all the empathy goes to elite people, and none goes to the people actually dying on our streets.”

Karp said that he and “many Palantirians are proud” to aid border security and anti-trafficker ops.

What’s Next: With Palantir’s AI tools scaling border enforcement, fentanyl flows could drop further, saving thousands of working-class lives, tightening labor markets for wage gains, and forcing elites to face the human cost of open-border policies.

Tech Roundup

🧠 AI

⭐ Editor’s Pick: OpenAI inked a $38 billion multiyear cloud deal with Amazon, tapping AWS for vast computing power—including Nvidia chips—to fuel its AI operations through 2026. (WSJ)

Alibaba's Qwen3-Max AI crushed U.S. rivals in a crypto-trading contest, yielding 22.32% on $10,000 in two weeks while OpenAI's GPT-5 bled 62.66%. (SCMP)

Microsoft committed $15.2 billion to the UAE through 2029 for AI and cloud infrastructure, including a $1.5 billion stake in G42 and over $4.6 billion in datacenters. (MS)

Agentic AI is poised to revolutionize this season’s holiday shopping with autonomous assistants that anticipate needs and personalize experiences, including Walmart's savings tools and Pandora's shopper agent Gemma. (CXT)

An international team unveiled Denario, an open-source AI research assistant that autonomously generates scientific papers in 30 minutes for $4 apiece. (VB)

🤖 Hardware & Robotics

⭐ Editor’s Pick: Toyota unveiled Walk Me, a four-legged robotic chair that autonomously climbs stairs, traverses rough terrain, and folds to carry-on size. (IE)

Germany's REWE launched the Circus CA-1 AI robot in its 'Fresh & Smart' stores, autonomously preparing hot meals around the clock and cutting operational costs by up to 95%. (ESM)

Chinese surgeons achieved a medical milestone by performing the world's first remote robotic sub-retinal injection in Xinjiang. (PD)

Kura Revolving Sushi Bar, famed for its conveyor-belt sushi and robot servers dubbed Kur-B, will debut at Jordan Creek Town Center in West Des Moines in late 2026. (DMR)

🚀 Defense & Space

⭐ Editor’s Pick: Belgium's defense minister labeled weekend drone incursions near the Kleine Brogel air base—home to U.S. nuclear weapons—a sophisticated “spy operation.” (CBS)

Russia launched the Khabarovsk, its first Project 08951-class nuclear-powered submarine, engineered to deploy six nuclear-armed, ultra-long-endurance torpedoes. (TWZ)

The Royal Navy conducted the world's first quantum navigation trial, deploying Infleqtion's Tiqker atomic clock on the uncrewed submarine to enable precise timing in GPS-denied environments. (DP)

China’s military deployed "wolf robots" in its latest amphibious training exercises, deploying them to clear obstacles, strike targets, and bolster airborne operations. (ABD)

💰Venture Capital

⭐ Editor’s Pick: Aerial robotics startup Infravision raised $91 million in a Series B round led by GIC. (CB)

Popai Health raised $11 million from Team8 and NEA to deploy its Voice AI platform, which transforms unstructured patient phone calls. (CTCH)

Augmented Intelligence raised $20 million in bridge funding at a $750 million valuation cap, with participation from eGateway Ventures. (VB)

Coherence Neuro raised $10 million in seed funding led by Topology Ventures to advance its closed-loop neuro system for cancer treatment. (TFN)

FREEDOM

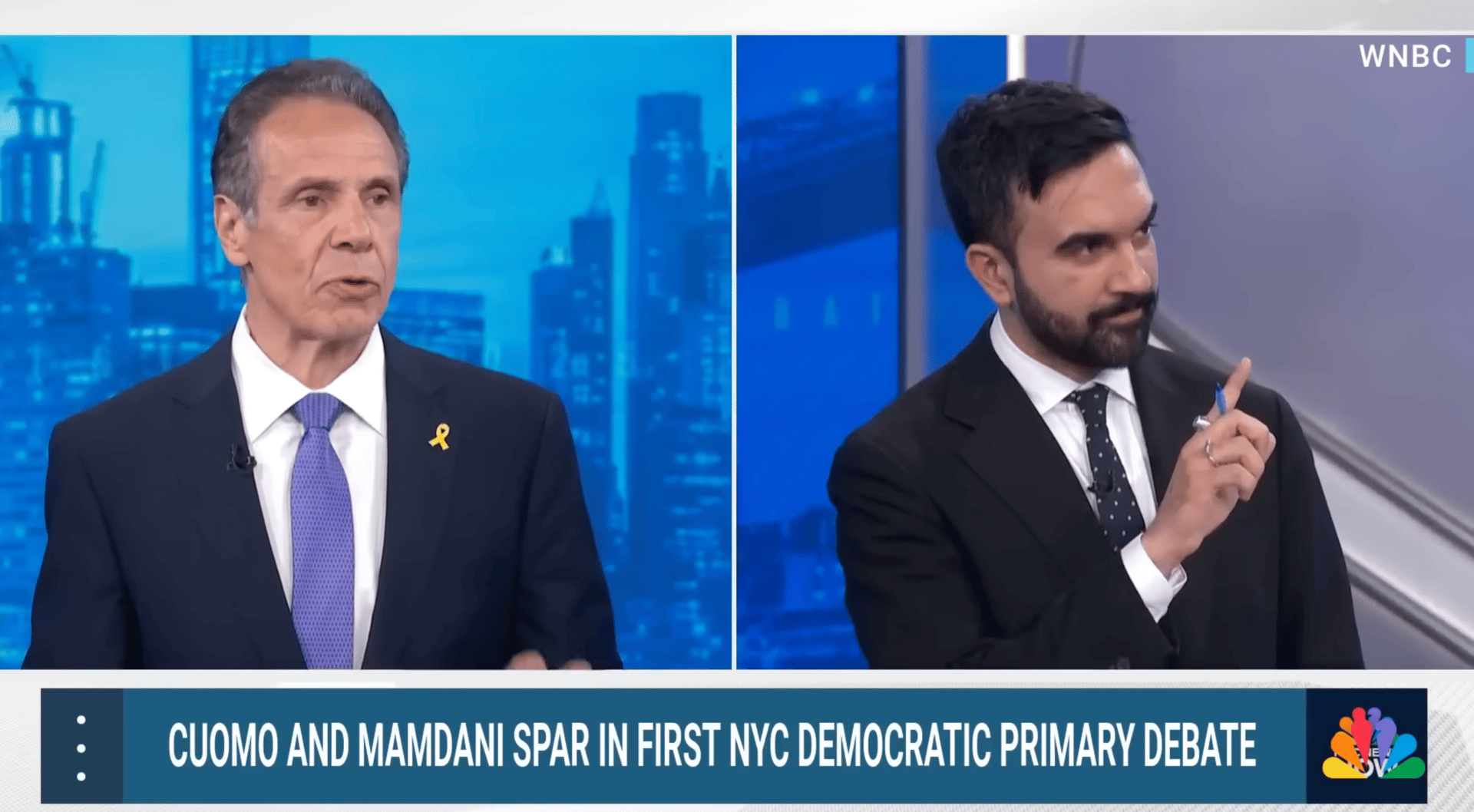

🇺🇸 Trump Backs Cuomo, Vows to Slash NYC Funds if “Communist” Mamdani Wins Mayor Race

(Credit: White House)

The Scoop: On the eve of New York City's mayoral election, President Donald Trump threw his weight behind independent Andrew Cuomo in a fiery Truth Social post—slamming Democrat front-runner Zohran Mamdani as a "Communist" whose win would doom the city to "total economic and social disaster," Fox News reports.

The Details:

Trump warned a Mamdani victory leaves NYC with “ZERO chance of success, or even survival,” vowing to withhold federal funding beyond the legal minimum: “I don’t want to send good money after bad.”

Trump branded Republican Curtis Sliwa a spoiler whose votes hand the keys to Mamdani, insisting New Yorkers “have no choice” but Cuomo: “Whether you like him or not, he’s capable—Mamdani is not!”

Cuomo brushed off Trump’s anti-Mamdani comments as not real support, warning Trump sees the socialist as an “existential threat” who’d bankrupt the city and invite federal takeover.

Mamdani fired back at a Bronx rally, dubbing Cuomo “Trump’s puppet” and the endorsement proof he’s the best mayor for the president—not New Yorkers—while calling funding threats illegal bluster.

What’s Next: Longer term, a Mamdani win would ignite a national radical left blueprint—expanding sanctuary policies and green initiatives, while Cuomo's victory signals elite pragmatism, potentially unlocking federal cash but alienating the left.

Freedom Roundup

🏛️ Policy & Culture

⭐ Editor’s Pick: A Wyoming mother prevailed in free-speech lawsuits against Sweetwater County School District officials, who sought to muzzle her social-media criticism. (RTN)

Paramount Global faces a lawsuit from former executive Joseph Jerome, who claims the company's DEI head fired him in a discriminatory purge targeting white men over 50. (TW)

Palantir CEO Alex Karp branded his tech company the first "completely anti-woke" outfit on its Q3 earnings call, crediting a meritocratic ethos and "lethal technology." (BI)

Trump’s crypto and AI czar David Sacks warned that artificial intelligence's gravest peril lies not in a Terminator-style uprising but in an Orwellian regime of surveillance and information manipulation. (X)

That's a wrap! You're officially caught up on all things tech, markets and freedom. Subscribe to CAPITAL below.

Feel free to reply to this email with any questions and/or comments.

DISCLAIMER: The CAPITAL newsletter is for informational purposes only and does not constitute financial, investment, or professional advice. Readers should conduct their own research and consult a qualified financial advisor before making investment decisions. The CAPITAL newsletter and its owner and operator, Josh Caplan, are not liable for any loss or damage resulting from reliance on this information. The CAPITAL newsletter is solely owned and independently operated by Josh Caplan, separate from any employer affiliations.