Welcome back!

Here’s your must-read news this morning:

I’ve got all the details for you, so let’s dive in.

— Josh

MARKETS

💰 How Dominari Holdings Became the Trump Family's Trusted Dealmaker

(Credit: Gage Skidmore)

The Scoop: Dominari Holdings, led by CEO Anthony Hayes and President Kyle Wool from their Trump Tower office in New York, has transformed from a small biotech firm into a key financial player for the Trump family’s business empire, handling deals in crypto, U.S. manufacturing, and more, the Wall Street Journal reports.

The Details:

Originally Spherix, later AIkido Pharma, Dominari shifted from biotech to finance in 2021 under Hayes, amassing a $66 million cash pile during the pandemic.

Moving into Trump Tower in 2021, Dominari built ties with Eric and Donald Trump Jr. through charity events and golf outings, becoming their go-to dealmaker.

The firm facilitated a Trump-backed Bitcoin-mining venture, American Bitcoin, raising $220 million, and advised on a SPAC to take a U.S. manufacturer public, with Eric and Donald Trump Jr. each holding 6.7% stakes in Dominari, valued at over $6 million.

Despite $223 million in accumulated losses and a $23 million net loss in 2023, Dominari’s revenue grew in 2024, boosted by Trump-related deals and investments in SpaceX, xAI, and crypto ventures like Tron.

Relationships with figures like Justin Sun, tied to the Trumps’ World Liberty Financial, have fueled high-value deals, including a $120 million investment gain for Dominari.

What’s Next: Dominari’s growing clout in the Trump business network, combined with increasing interest from Wall Street players eager to tap into its exclusive deals, positions the firm for a bright future in high-growth sectors like crypto and AI.

Markets Roundup

🏦 Economy & Policy

⭐ Editor’s Pick: S&P Global affirmed the U.S. long-term credit rating at AA+ and short-term rating at A-1+ with a stable outlook. (BBG)

The Trump administration is considering a 10% stake in Intel to bolster chipmaking and national security. (BBG)

Germany insists the U.S. must reduce car tariffs as agreed before finalizing a broader U.S.-EU trade deal. (RTS)

Federal Reserve Chair Jerome Powell is expected to signal a 25-basis-point interest rate cut for September at the Jackson Hole symposium, according to Evercore ISI analysts. (INV)

China’s youth unemployment rate for 16- to 24-year-olds, excluding college students, rose to 17.8% in July from 14.5% in June, amid a slowing economy. (RTS)

📈 Stock Market

⭐ Editor’s Pick: Chamath Palihapitiya is seeking to return to the SPAC industry with a $250 million fund focused on AI, DeFi, defense, or energy. (PB)

Xiaomi reported a 31% year-over-year revenue increase to $16.2 billion for Q2, surpassing estimates of $16 billion, with net income soaring 75.4% to $1.6 billion. (BBG)

Palo Alto Networks outperformed Wall Street’s fiscal fourth-quarter expectations with adjusted earnings of 95 cents per share and $2.54 billion in revenue. (CNBC)

Wall Street’s major indexes closed flat as investors awaited retailer earnings from Walmart, Home Depot, and Target, and the Federal Reserve’s Jackson Hole symposium for insights on economic policy. (INV)

💵 Energy & Commodities

⭐ Editor’s Pick: The Trump administration’s USDA banned solar and wind projects on farmland, ending over $2 billion in subsidies. (OP)

Google and Kairos Power will deploy an advanced nuclear reactor to power the tech giant’s data centers on the Tennessee Valley Authority grid by 2030. (CNBC)

China’s rare earth exports surged 69% in July to 6,422 tons, the highest since January, reflecting eased export restrictions amid a trade truce with the U.S. (MIN)

UBS raised its gold price target for March 2026 by $100 to $3,600 per ounce and for June 2026 by $200 to $3,700 per ounce, citing robust demand from ETFs and central banks. (MW)

🌕 Crypto

⭐ Editor’s Pick: Tether appointed Bo Hines, former head of Trump’s White House Crypto Council, as a strategic advisor to lead its U.S. market expansion. (CD)

Solana achieved a major accomplishment over the weekend, processing 107,540 transactions per second in a mainnet stress test. (CRY)

South Korea ordered local crypto exchanges to suspend lending services, citing legal uncertainties and potential user losses, pending new regulatory guidelines. (CN)

The SEC postponed decisions on a Bitcoin and Ethereum ETF fund proposed by Trump Media, as well as XRP and Dogecoin ETFs, with a new deadline set for October 8. (DC)

SPONSOR

Swap, Bridge, and Track Tokens Across 14+ Chains

Meet the Uniswap web app — your hub for swapping, bridging, and buying crypto across Ethereum and 14 additional networks.

Access thousands of tokens and move assets between chains, all from a single, easy-to-use interface.

Trusted by millions, Uniswap includes real-time token warnings to help you avoid risky tokens, along with transparent pricing and open-source, audited contracts.

Whether you're exploring new tokens, bridging across networks, or making your first swap, Uniswap keeps onchain trading simple and secure.

Just connect your wallet to get started.

TECH

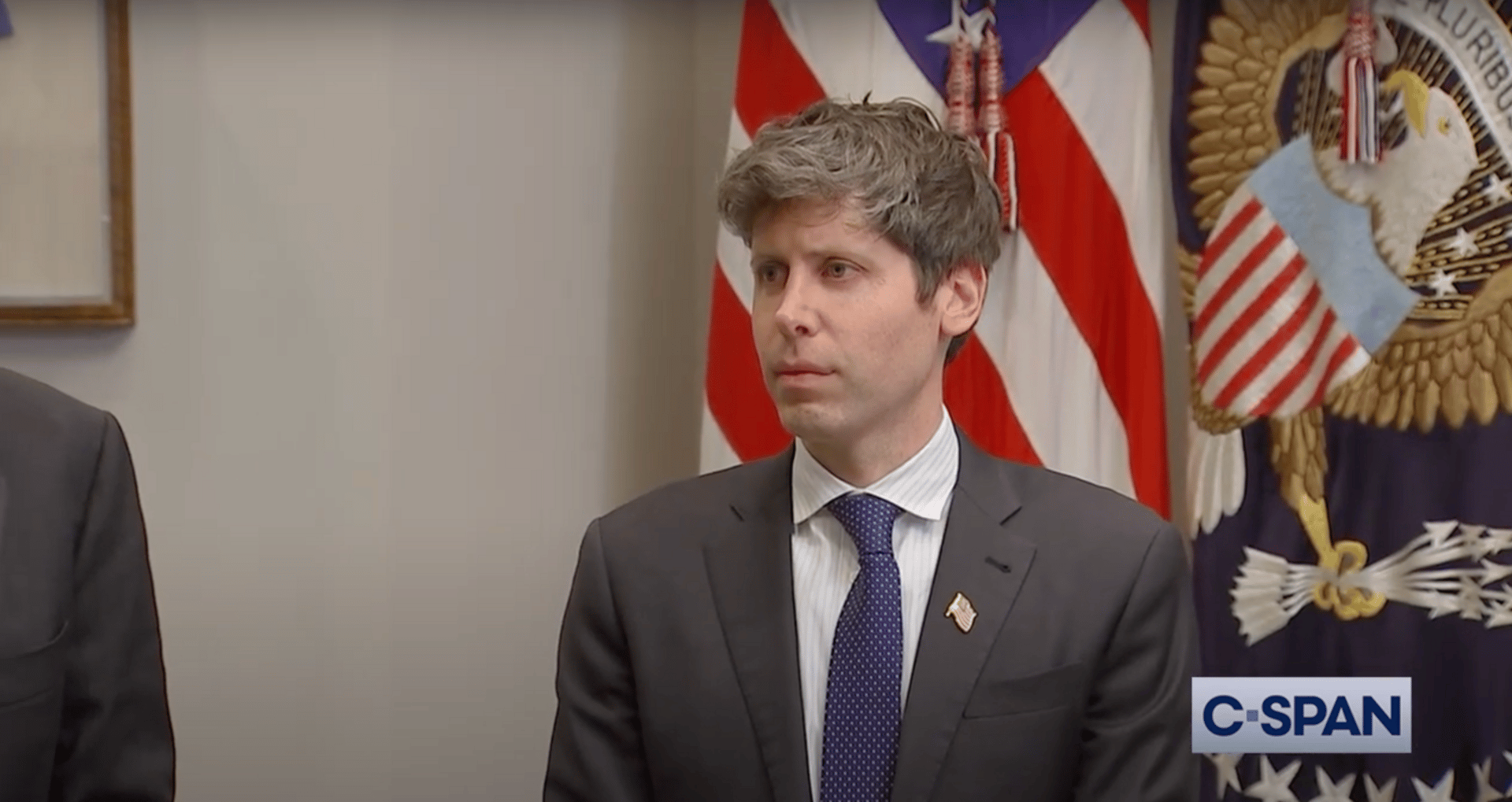

💻 OpenAI’s Sam Altman Warns U.S. Underestimates China’s Rapid AI Advancements

(Credit: CSPAN)

The Scoop: In a rare on-the-record briefing in San Francisco, OpenAI CEO Sam Altman warned, "I’m worried about China," expressing concern that the U.S. is underestimating the complexity and speed of China’s AI advancements.

The Details:

Altman emphasized the multifaceted nature of the U.S.–China AI competition, stating, “There’s inference capacity, where China probably can build faster. There’s research, there’s product; a lot of layers to the whole thing,” and cautioned that it’s not just about who’s ahead.

Altman expressed skepticism about U.S. export controls, saying, “My instinct is that doesn’t work,” noting that restrictions on GPUs may be bypassed as “maybe people build fabs or find other workarounds,” referring to semiconductor fabrication facilities.

U.S. policies, tightened under Biden and escalated by Trump to halt advanced chip supplies, now allow “China-safe” chips, with Nvidia and AMD sharing 15% of revenue from China with the U.S. government.

China’s open-source AI models, like DeepSeek, influenced OpenAI’s decision to release open-weight models, gpt-oss-120b and gpt-oss-20b.

What’s Next: OpenAI’s release of open-weight models, driven by Altman’s concerns about Chinese competition, positions the company to attract global developers and maintain influence in AI’s future. With increasing interest from Wall Street and tech communities in AI’s potential, OpenAI’s strategic shift could accelerate innovation in coding and enterprise applications, strengthening its edge in a rapidly evolving global market.

Tech Roundup

🧠 AI

⭐ Editor’s Pick: Nvidia is developing a new AI chip for China, based on its advanced Blackwell architecture, designed to outperform the H20 model while navigating U.S. export controls. (RTS)

OpenAI launched ChatGPT Go, a $4.57 monthly subscription plan in India, its most affordable offering yet. (CNBC)

Madison Avenue advertising agencies, including Publicis and Omnicom, are increasingly adopting generative AI to create commercials. (NYT)

The FDA granted de novo authorization to ArteraAI’s Prostate Test, the first AI-powered software to predict long-term outcomes for prostate cancer. (QZ)

AI-designed physics experiments, initially appearing bizarre, have proven effective in revealing new insights, demonstrating the technology’s potential to revolutionize scientific discovery. (WIR)

🤖 Hardware & Robotics

⭐ Editor’s Pick: Chinese surgeons successfully performed an unprecedented procedure to rebuild a man’s neck after a robotic arm accident nearly decapitated him. (IE)

Las Vegas restaurants and hotels are increasingly adopting robotic staff, from cocktail-mixing machines to delivery bots.

The iXi Golf Trolley, an AI-powered robotic caddie, follows golfers, tracks performance, and carries clubs, offering a lightweight alternative to human caddies. (CORE)

Hong Kong will deploy robotic dogs to spray insecticide in hard-to-reach areas, aiming to combat the mosquito-borne Chikungunya virus. (TEL)

🚀 Defense & Space

⭐ Editor’s Pick: Ukraine proposed a $100 billion U.S. weapons purchase, financed by Europe, and a $50 billion drone production partnership to secure security guarantees after a potential peace deal with Russia. (FT)

A Ukrainian sniper set a world record by eliminating two Russian soldiers with a single AI-assisted shot from 2.5 miles using a Snipex Alligator rifle. (TVP)

U.S. Space Command is preparing for potential satellite-on-satellite combat, developing tactics to counter adversaries like China. (ECON)

AI is poised to revolutionize military command structures by automating routine tasks, shrinking bloated headquarters, and enabling faster decision-making on battlefields, a report says. (TCON)

💰 Venture Capital & Deals

⭐ Editor’s Pick: SoftBank will invest $2 billion in Intel, acquiring a 2% stake at $23 per share. (CNBC)

AI analytics platform Databricks is raising funds at a $100 billion valuation, a significant leap from its $62 billion valuation less than a year ago. (WSJ)

Eight Sleep secured $100 million in Series D funding from investors including Valor Equity Partners and Founders Fund to advance its AI-powered Pod mattress. (TC)

IVIX, an Israeli startup focused on AI-driven financial fraud detection, secured $60 million in Series B funding led by O.G. Venture Partners. (WSJ)

FREEDOM

📱 In U.S. Privacy Victory, UK Drops Demand for iPhone Encryption Backdoor

(Credit: Tuur Tisseghem/Pexels)

The Scoop: Britain has dropped its demand for Apple to create a backdoor to access encrypted user data in iCloud, following months of negotiations led by Director of National Intelligence Tulsi Gabbard, resolving a major dispute over electronic privacy.

The Details:

The dispute began earlier this year when the UK issued a secret “technical capability notice” under the Investigatory Powers Act of 2016, compelling Apple to provide access to encrypted iCloud data, raising concerns about privacy violations.

Gabbard said the UK’s demand would have been a “clear and egregious violation of Americans’ privacy and civil liberties,” potentially exposing data to cyber exploitation.

Apple resisted the order, withdrawing its Advanced Data Protection feature, which offers end-to-end encryption for iCloud data, for UK users to avoid compliance.

Gabbard worked with U.S. and UK officials to address the issue, citing violations of the U.S.-UK CLOUD Act, which prohibits demands for U.S. citizens’ data.

What’s Next: With the UK’s backdoor mandate scrapped, Apple may reinstate its Advanced Data Protection feature for UK users, bolstering consumer trust in encrypted services. The resolution strengthens U.S.-UK cybersecurity ties and sets a precedent for protecting digital privacy, though ongoing global debates over encryption and security could spark similar challenges.

Freedom Roundup

🏛️ Policy, Free Speech & Woke Overreach

⭐ Editor’s Pick: Veteran Boston TV anchor Katherine Merrill sued CBS and Paramount Global, alleging racial discrimination from DEI policies that labeled her morning show “too white,” leading to her demotion and resignation. (NYP)

A Canadian nurse was fined $93,000 by the British Columbia nursing college for online comments stating sex is binary and for helping to pay for a billboard expressing support for J.K. Rowling. (NP)

A UK council replaced "husband" and "wife" with "partner" in official documents, igniting criticism for erasing traditional marriage terminology. (SUN)

The average American taxpayer will receive a $3,752 tax cut in 2026 under Trump’s “One Big Beautiful Bill” Act. (BN)

That's a wrap! You're officially caught up on all things tech, markets and freedom. Subscribe to CAPITAL below.

Feel free to reply to this email with any questions and/or comments.

DISCLAIMER: The CAPITAL newsletter is for informational purposes only and does not constitute financial, investment, or professional advice. Readers should conduct their own research and consult a qualified financial advisor before making investment decisions. The CAPITAL newsletter and its owner and operator, Josh Caplan, are not liable for any loss or damage resulting from reliance on this information. The CAPITAL newsletter is solely owned and independently operated by Josh Caplan, separate from any employer affiliations.